I will talk about electronic money this week.

Electronic money is that the payment services to be provided by utilizing information and communication technology, by the company. Currency and which is positioned legally, it is not a so-called currency itself.

By bank transfer or credit card payment system has been underway to be on-line, does not mean that there was no electronic means of payment. Electronic money has now also available in consumers since the 1990s is the concept in the 1980s, the settlement method of the conventional techniques such as IC card also those dedicated to the settlement over the Internet and they are different the features as enhanced convenience by eliminating the disadvantages.

Electronic money is a token provided by the employer a function rather than a physical currency called coins and banknotes, currency corresponds to the electronically using the IC card, such as a network or. In the sense that the currency can be exchanged electronically, but can also be considered in the broad sense and also electronic money transfer or credit card at the bank, in the narrow sense it refers to a type of prepaid payment system is generally.

Electronic money is a method for payment by electronic data, the economy away money has been exchanged by an article that is substantially money. In that sense, can be called a kind of money into electronic money of the real state of the market economy is moving in the electronic telegraph. There are several ways of settlement or in the way of electronic money.

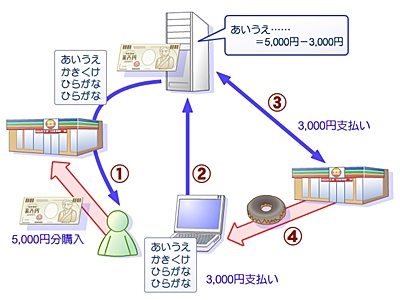

Online system : Method of completing a settlement connected with the host computer and the company's online electronic money services, financial institutions or credit card companies, such as retail terminals for settlement. Analogous to credit cards, etc., which has the advantage of easy to reuse.

Offline method : Method to perform off-line payment by payment terminals, such as retail stores, such as IC card housed in the electronic and magnetic card cash value. Is mostly due to non-contact IC card in terms of security.

Virtual money system : Method using only transactions between computer network as a virtual coupon. Those that interact with servers on the net e-money services company, between the user's computer, and is managed by the argot or secret ID / password, especially mainstream. Were seen introduced in the late 1990s as a means of payment methods a virtual money in online shopping. It cannot be used in the real stores and vending machines, convenience is the mainstream of electronic money payment is money these virtual services over the internet still well in terms of ease and flexibility

Those based on transport operators such as Suica · ICOCA · PASMO to use the non-contact type IC card, those based on a distribution business such as nanaco · WAON, as concrete examples of electronic money to those independent, such as Edy divided. In addition, electronic money using the non-contact type IC card that function has become to be included in the mobile phone. When equipped with these features to the mobile phone, mobile phone can easily be used to charge the pre-money. Has increased rapidly from users of electronic money, such as the mutual use of electronic money that businesses in the transportation system begins, the use of a convenience store is now available, which is highly convenient for a small payment .

As the past era, the Internet has come to be used more and more. Era of electronic money become mainstream is not used much cash might come.

No comments:

Post a Comment